For the first time ever, something as boring as the Fannie Mae Loan Level Price Adjustment (LLPA) Matrix has gone viral.

On May 1, 2023, Fannie Mae rolled out higher fees and rates for borrowers with good credit and, simultaneously, gave lower-credit buyers huge discounts.

Major media outlets, TikTok, and other social media channels picked up the story, which gained incredible momentum.

Is it a conspiracy against responsible buyers? A left-wing agenda? Or a much-needed boost for lower-credit buyers? We won’t try to answer or take a side, but it is worth discussing the impacts on the average real estate investor.

Do the Fannie Mae LLPA changes affect real estate investors?

In a word: maybe.

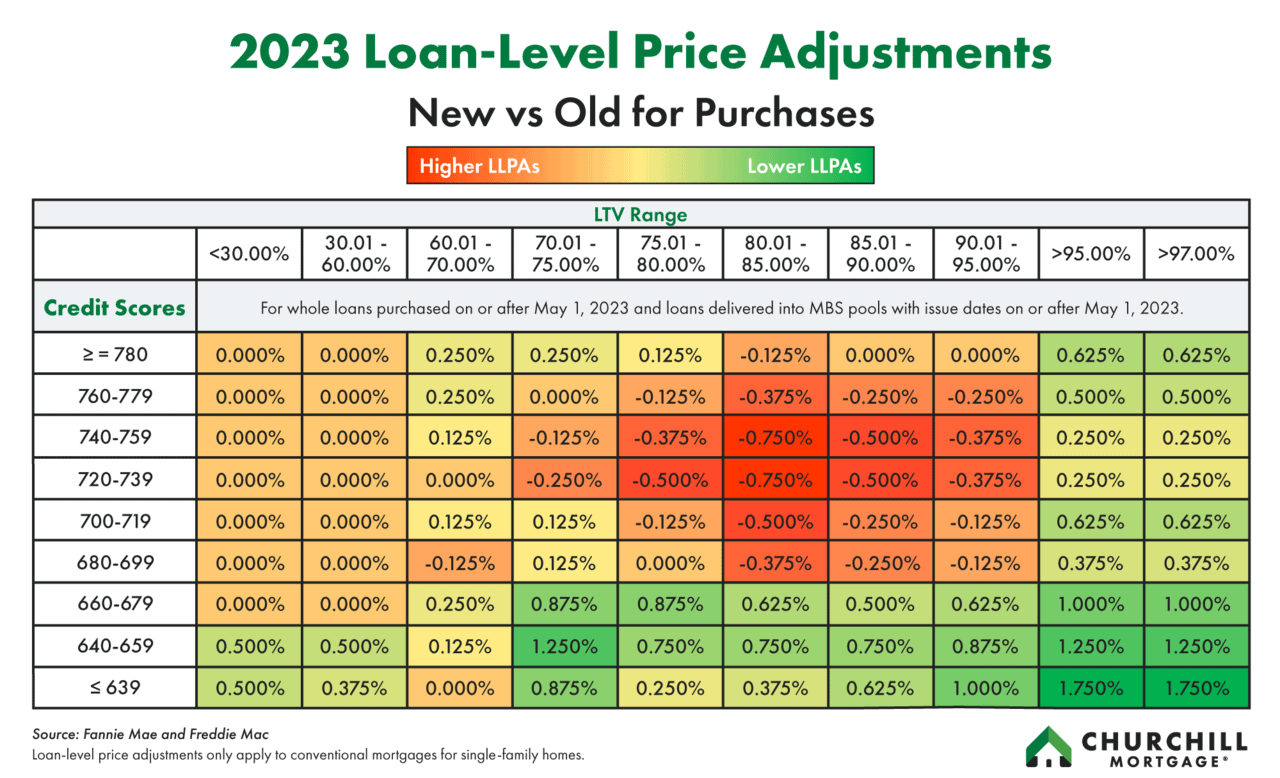

The simple answer is that those who have high credit and use a conventional loan for financing may see higher rates. Churchill Mortgage created a fantastic chart to show where prices were “heating up” and where they were cooling.

Keep in mind that the percentages are talking about points, not rate. For instance, someone with a 760 score putting 20% down would pay 0.375% of the loan amount more than they did before, or $1,125 in additional points on a $300,000 mortgage. Instead of taking the higher cost, they could increase their rate by around 0.125%.

In short, if you buy an investment property with a conventional Fannie Mae or Freddie Mac loan with a credit score above 679, you’ll pay more than you did before.

So are low-credit investors paying less than high-credit investors now?

The media frenzy was fueled by a key piece of misinformation that was, while viral, quite incorrect.

The idea was that low-credit buyers would now pay less overall than those with good credit.

This was a misunderstanding at best, and, at worst, a blatant lie to gain views and clicks.

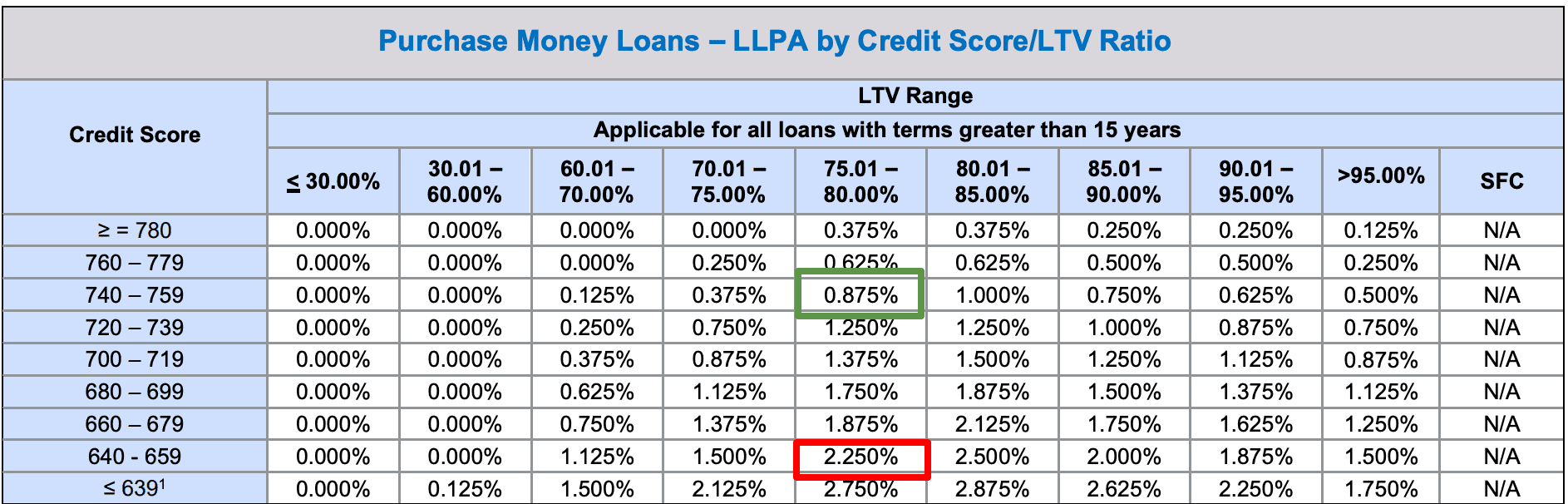

Below, you see that lower credit tiers still pay more than high credit tiers. Again, remember that the below chart is talking about add-ons to points, not rate.

A buyer or real estate investor putting 20% down will pay more with a 640 score than with a 740 score, to the tune of 1.375% of the loan amount in fees. This likely equates to about 0.50-0.75% in rate.

So do not intentionally miss payments on your credit cards and auto loans to drive down your credit score and get a better rate. You will be in a world of hurt in more ways than one.

Fannie Mae has been hiking rates on investors long before May 1, 2023

If you’re an investor, you may be crying “May Day” after the May 1 changes. However, the Agencies (the nickname for Fannie Mae and Freddie Mac collectively) has had it out for investors for some time.

The Agencies’ mandate is primarily to promote owner-occupied homeownership, not subsidize investors.

As such, the heftiest fees have been levied on investment properties for a while now. The reason likely goes way beyond risk. Sure, it accounts for the more-risky nature of lending on rental properties, but it likely also signals the Agencies’ agenda.

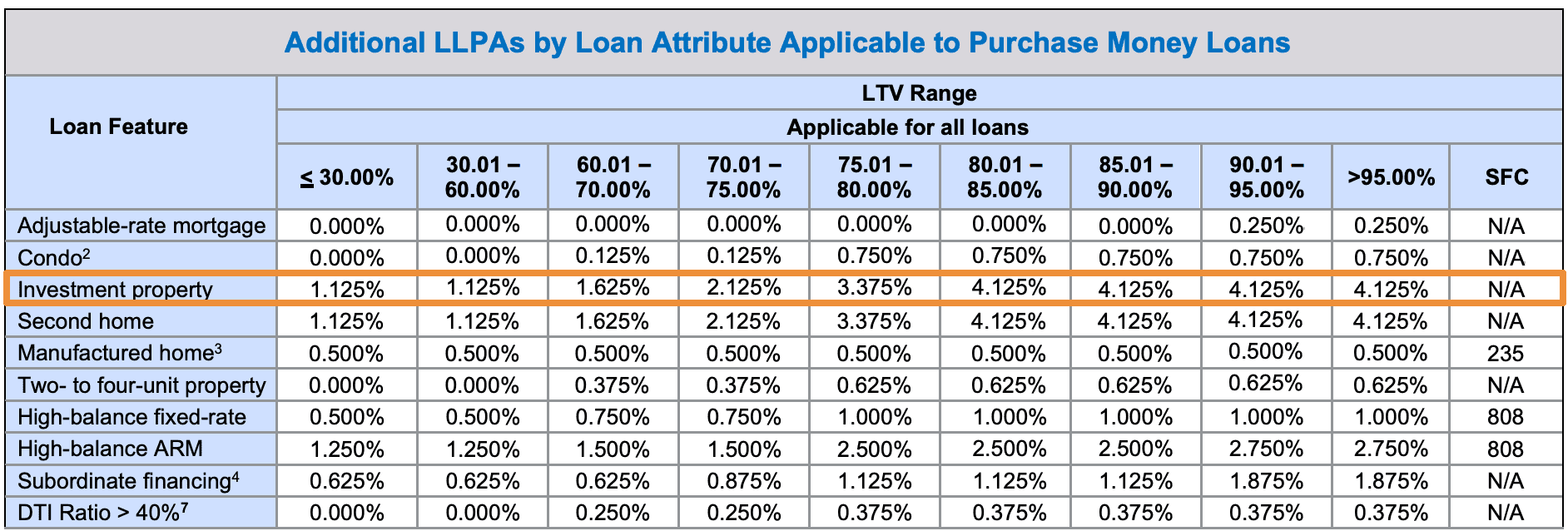

If you thought the recent credit score/LTV add-ons were big, take a look at this.

That’s right: on a $300,000 loan at 20% down, you’ll pay an eye–popping $10,125 more in fees, likely equaling at least 2 percentage points to your rate.

The extra fee you’ll pay as a 740-credit-score investor isn’t looking so bad in comparison.

All in, you’ll likely have a rate well over 7% if not near 8%, plus probably be paying points as well. Not to mention coming up with 20-25% down. Conventional lending isn’t looking so hot anymore, is it?

Conventional loan alternatives for real estate investors

Knowing that the Agencies are actively discouraging investors from using their products, why would someone consider them?

There are likely still scenarios where it makes sense. For instance, if you have 50% equity in an investment property, an 800 score, and you don’t need cash out, a conventional loan might be fine. Otherwise, consider the alternatives.

If you’re going to pay 8% anyway, consider a DSCR loan for a purchase or refinance. DSCR rates are currently in the 7s and 8s as of this writing. Plus, you don’t have to provide tax returns. You just have to prove the property will cash flow.

You can also go the hard money route. These loans allow you to buy and stabilize a property until you can get long-term financing in place, such as a DSCR loan.

Bank statement loans are often available for real estate investors and may not come with much higher rates than conventional. An added bonus: qualify by showing the lender 12-24 months of bank statements instead of tax returns.

Start on your investment property financing.Fannie Mae: Not the only game in town

If you’re one of the millions of real estate buyers upset about Fannie Mae’s recent “good credit penalty,” you have solace in knowing that the Agencies are not the only game in town.

The non-QM market is opening up, and the Agencies seem to be pushing investors to start using these loans.

And the fact that conventional and non-QM rates are now very similar should be all the more reason to look into alternative financing solutions.

Explore non-QM lending solutions.Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.