Your Best Mortgage Options — Instantly

- Get matched with vetted mortgage lenders in minutes

- Save time with one simple form — no need to shop dozens of sites

- No credit impact. No sales pressure. Just the best fit for your goals

Getting preapproved for a mortgage online has become a game-changer in the home buying process. It offers convenience, speed, and a clear picture of your borrowing power before you start house hunting.

At My Perfect Mortgage, we’ve seen firsthand how online preapproval can streamline the home buying journey. In this guide, we’ll walk you through the steps to get preapproved for a mortgage online and explain what to expect during the process.

Mortgage preapproval is a key step in the home buying process. It’s an official statement from a lender that indicates how much they will lend you based on your financial profile. This process gives homebuyers a significant advantage in today’s competitive real estate market.

Online preapproval offers several benefits:

Many people confuse preapproval with prequalification, but they differ significantly:

A preapproval letter provides several advantages:

Many real estate agents won’t show homes to buyers without a preapproval letter. According to the National Association of Realtors’ 2023 Profile of Home Buyers and Sellers, the typical first-time homebuyer only put down 8%.

The preapproval process typically involves these steps:

It’s important to note that while preapproval is a strong indicator of your ability to secure a mortgage, it’s not a guarantee. Final loan approval will depend on factors like the home’s appraisal and any changes in your financial situation.

As we move forward, we’ll explore the specific steps to get preapproved for a mortgage online, making your home buying journey smoother and more efficient.

Before you start the online preapproval process, collect all necessary financial documents. These typically include:

Self-employed individuals need to provide additional documentation, such as profit and loss statements and business tax returns.

Selecting the right online lender is important. Look for lenders with user-friendly interfaces, competitive rates, and positive customer reviews. My Perfect Mortgage offers a seamless online experience and matches you with lenders suited to your unique financial situation.

When comparing lenders, pay attention to:

A J.D. Power study investigates customer satisfaction with the mortgage origination experience based on performance in four factors. However, My Perfect Mortgage provides a more personalized approach, which can lead to better matches and rates for individual borrowers.

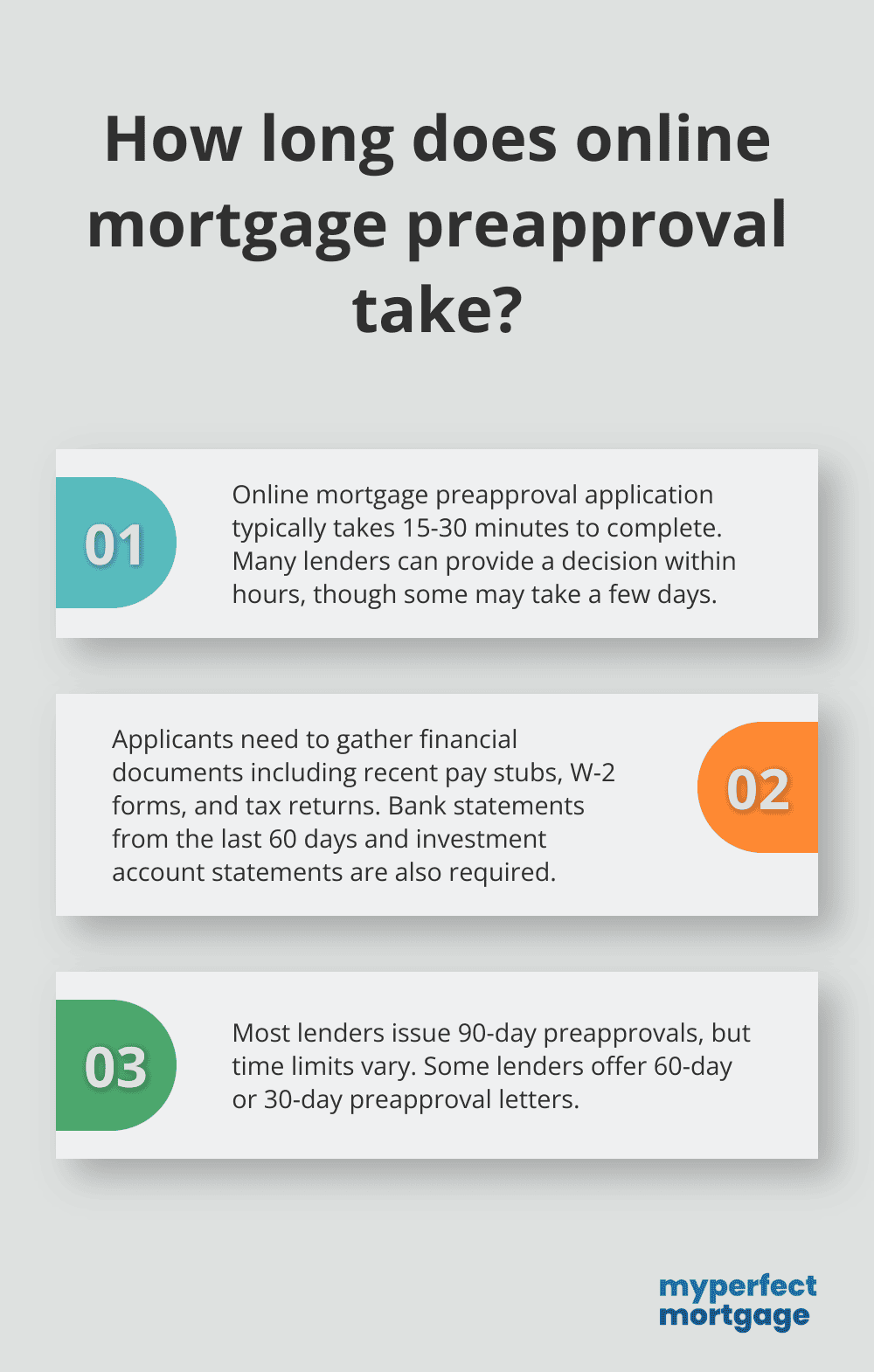

After you choose a lender, fill out the online application. This process usually takes about 15-30 minutes. You’ll need to provide:

Provide honest and accurate information. Any discrepancies could delay the process or even lead to a denial.

After you complete the application, upload the financial documents you gathered earlier. Most online platforms have secure systems for document uploads. Double-check that all pages are included and legible to avoid delays.

Once you submit everything, the waiting begins. Online preapprovals are often much faster than traditional methods. Many lenders can provide a decision within hours (though some may take a few days).

During this time, the lender will review your application, verify your information, and perform a hard credit check. Multiple hard inquiries from loan applications can hurt your credit scores, but the impact could depend on which loans you apply for.

If approved, you’ll receive a preapproval letter stating the loan amount you qualify for, the type of loan, and the interest rate. Most lenders issue 90-day preapprovals, but each lender sets its own time limit, and letters with 60-day and 30-day limits are issued as well.

A preapproval is not a guarantee of a loan. The final approval will depend on the specific property you choose and any changes in your financial situation. However, with a preapproval in hand, you’re well-positioned to start your home search with confidence.

Now that you understand the steps to get preapproved for a mortgage online, let’s explore what you can expect during the process and how it affects your financial profile.

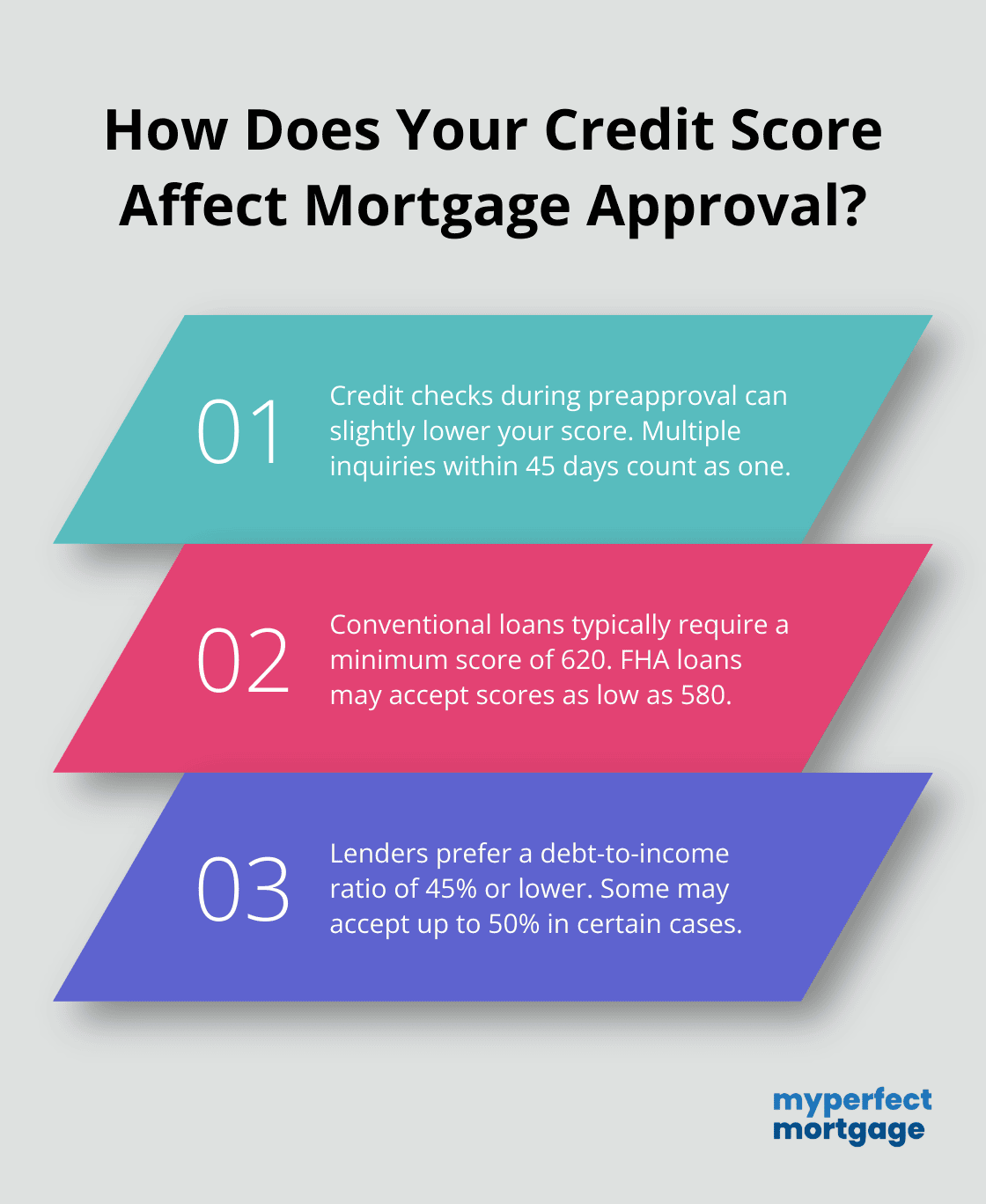

When you apply for preapproval, lenders perform a hard credit inquiry. This action typically has a small negative effect on your credit scores. However, if you shop around, multiple mortgage inquiries within a 45-day window are typically treated as a single inquiry by credit scoring models.

Your credit score plays a key role in determining your interest rate and loan terms. For conventional loans, most lenders require a minimum score of 620. FHA loans may accept scores as low as 580. If your score falls on the lower end, take steps to improve it before applying. Paying down credit card balances and resolving any errors on your credit report can make a significant difference.

Lenders calculate your debt-to-income ratio (DTI) to assess your ability to manage monthly payments. They typically prefer a DTI of 45% or lower (including your potential mortgage payment), although some lenders may accept ratios as high as 50% in certain cases. To calculate your DTI, add up all your monthly debt payments and divide by your gross monthly income.

If your DTI is high, pay off some debts before applying for preapproval. Even small reductions in your debt load can improve your DTI and potentially qualify you for better loan terms.

Lenders want to ensure you have a stable income to support your mortgage payments. They typically verify your employment and income for the past two years. If you’ve changed jobs recently, prepare to explain any gaps or changes in your employment history.

For self-employed individuals, most mortgage lenders require at least two years of steady self-employment before you can qualify for a home loan. You’ll likely need to provide tax returns and profit and loss statements for the past two years. Some lenders may require additional documentation to verify your business income stability.

Lenders review your bank statements and other asset documents to verify you have enough funds for the down payment and closing costs. They also want to see that you have reserves (typically a few months of mortgage payments) in case of financial emergencies.

Prepare to explain any large deposits or withdrawals in your accounts. Lenders need to ensure that all funds come from legitimate sources and not from undisclosed loans.

Based on the information you provide and the lender’s assessment, you’ll receive an estimated loan amount and interest rate. This estimate gives you a clear picture of your purchasing power and helps you focus your home search on properties within your budget.

Keep in mind that these figures are estimates and may change based on the specific property you choose and any fluctuations in market conditions. The final loan terms will be determined when you find a home and move forward with the full mortgage application process.

Online mortgage preapproval has transformed the home buying process. It offers speed, convenience, and a clear understanding of your budget. You can now focus your search on properties within your means and demonstrate to sellers that you’re a serious buyer. This process also helps you identify and address potential issues in your financial profile before finding your dream home.

My Perfect Mortgage simplifies the process to get preapproved for a mortgage online. Our platform matches you with lenders suited to your specific financial circumstances. We provide personalized assistance, tools, and educational resources to help you navigate different loan types, including FHA, VA, USDA, and jumbo loans.

You can explore various loan options through our user-friendly platform. Our network of real estate partners provides guidance throughout your home buying journey. With My Perfect Mortgage, you can approach the preapproval process confidently, knowing you have the resources and support to make informed decisions.

Our advice is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.