Your Best Mortgage Options — Instantly

- Get matched with vetted mortgage lenders in minutes

- Save time with one simple form — no need to shop dozens of sites

- No credit impact. No sales pressure. Just the best fit for your goals

Are you in the market for a high-value property? You might need to explore jumbo mortgage loans. These specialized financial products cater to homebuyers seeking loans that exceed conventional lending limits.

At My Perfect Mortgage, we often get asked, “What are jumbo mortgage loans?” In this post, we’ll break down the essentials of jumbo loans, their qualification requirements, and how they compare to conventional mortgages.

Jumbo loans are considered non-conforming loans because they exceed the loan limits set by the FHFA each year for conventional mortgages. In 2024, the conforming loan limit for most areas in the United States is $766,550. Any mortgage above this amount falls into the jumbo loan category.

The primary distinction between jumbo and conventional loans lies in their size and backing. Conventional loans typically receive backing from government-sponsored enterprises like Fannie Mae and Freddie Mac, while jumbo loans do not. This lack of government support increases the risk for lenders, resulting in more stringent qualification requirements for borrowers.

Loan limits are not uniform across the country. The 2024 conforming loan limit is $766,550, which is a $40,350 increase from 2023. This variation reflects the significant differences in housing costs across different regions (often due to factors like local economy and housing demand).

The higher risk associated with jumbo loans leads lenders to impose more rigorous requirements on borrowers. These typically include:

These stringent requirements ensure that borrowers can handle the larger loan amounts.

Despite the stricter criteria, many lenders specialize in jumbo loans and offer competitive rates. Some borrowers might even find jumbo loan rates comparable to or lower than conventional loan rates, depending on market conditions and their financial profile.

As we move forward to discuss the qualification process for jumbo mortgages, it’s important to understand that these loans require a more comprehensive financial assessment. Let’s explore the specific requirements that lenders consider when evaluating jumbo loan applications.

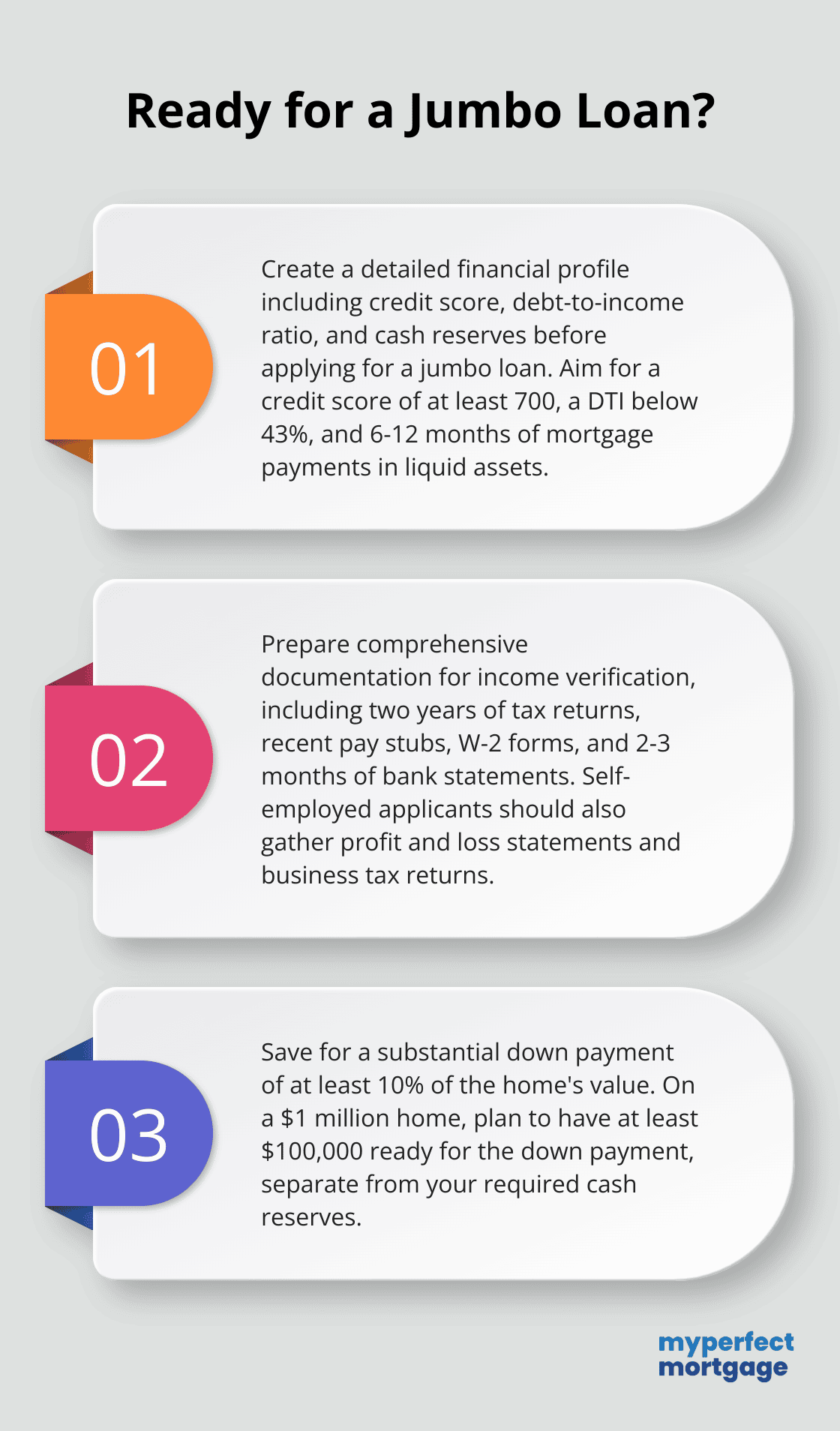

The minimum credit score for a Jumbo Smart ARM is 740. This high credit score requirement underscores the importance of an excellent credit profile for these high-value mortgages.

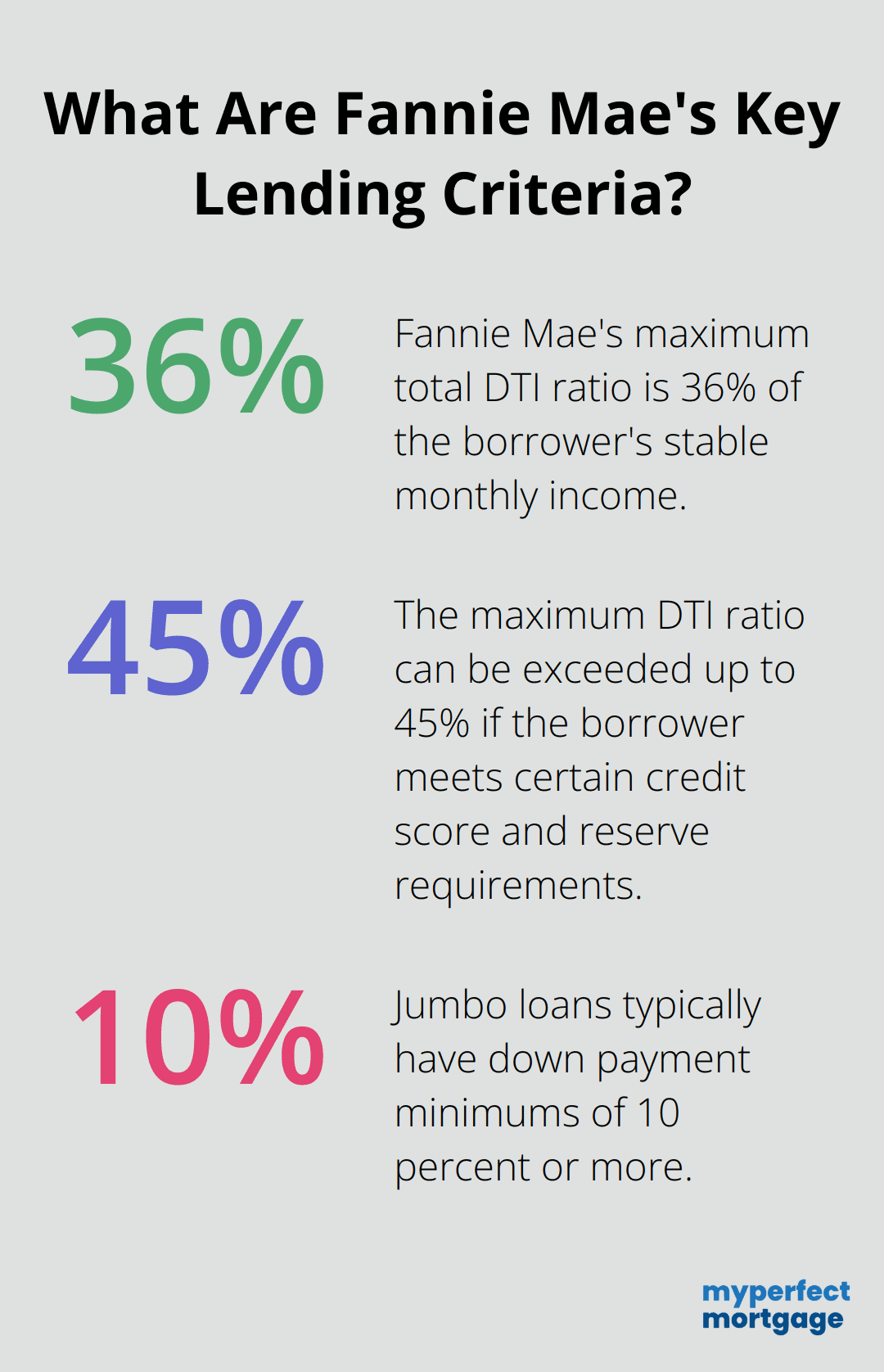

Fannie Mae’s maximum total DTI ratio is 36% of the borrower’s stable monthly income. The maximum can be exceeded up to 45% if the borrower meets certain credit score and reserve requirements. To calculate your DTI, divide your total monthly debt payments by your gross monthly income.

Jumbo loans typically have much larger down payment minimums: 10 percent or more. On a $1 million home, this translates to at least $100,000 down. Some lenders may require even higher down payments, which could result in more favorable interest rates or terms.

Lenders scrutinize income sources and assets more closely for jumbo loans. You should prepare to provide:

Self-employed applicants may need to supply additional documentation (such as profit and loss statements or business tax returns).

Many lenders require substantial cash reserves, often 6-12 months of mortgage payments. These reserves should be in liquid assets, separate from your down payment.

These stringent requirements underscore the importance of thorough preparation when applying for a jumbo mortgage. Improving credit scores, reducing existing debts, and accumulating necessary reserves can significantly increase your chances of approval. However, it’s important to note that criteria can vary between lenders. Working with a platform that connects you with lenders who best fit your financial profile can potentially lead to more favorable terms or requirements.

As we move forward, let’s explore the advantages and disadvantages of jumbo loans to help you determine if this type of mortgage aligns with your financial goals and circumstances.

Jumbo loans allow you to purchase expensive homes that exceed conforming loan limits. In 2024, jumbo loan limits vary by county and territory, with some exceeding the standard $766,550. For luxury real estate markets (like San Francisco or New York City), jumbo loans often represent the only viable option for financing premium properties.

Contrary to popular belief, jumbo loan rates can compete with or even undercut conventional mortgage rates. As of December 6, 2024, the national average 30-year fixed jumbo mortgage rate stood at 6.87%, down compared to last week’s 6.95%. This difference can lead to significant savings over the life of the loan, especially on larger loan amounts.

Jumbo loans offer benefits but require a more rigorous approval process. Most lenders require a minimum credit score of 660, but some jumbo loan programs may have different requirements depending on your financial situation. Your debt-to-income ratio should ideally fall below 43%, and you’ll need to provide extensive documentation of your income and assets.

Borrowers who improve their credit scores and reduce their debt before applying often secure better terms. We suggest you start this process at least six months before you plan to apply for a jumbo loan.

Jumbo loans often come with increased closing costs and fees due to the heightened risk for lenders. You might encounter higher appraisal fees, as some lenders require multiple appraisals for jumbo loans. Additionally, private mortgage insurance (PMI) can cost more for jumbo loans, potentially adding hundreds of dollars to your monthly payment if you put down less than 20%.

Factor these additional costs into your budget when considering a jumbo loan. Mortgage calculators can help you estimate these expenses and determine how they’ll impact your overall financial picture.

Jumbo loans offer flexibility in the types of properties you can finance. These loans can cover primary residences, vacation homes, and investment properties. This versatility allows you to expand your real estate portfolio or invest in high-value properties that might otherwise be out of reach with conventional financing options.

Jumbo mortgage loans exceed conforming loan limits set by the Federal Housing Finance Agency. These loans enable borrowers to finance high-value properties with competitive interest rates and flexible terms. Individuals seeking luxury homes or investing in expensive real estate markets benefit most from jumbo loans.

The jumbo loan landscape can be complex, with varying requirements among lenders. My Perfect Mortgage specializes in matching clients with ideal mortgage lenders for their unique financial situations. We offer personalized assistance and educational resources to help navigate the jumbo loan process.

Jumbo loans can be a powerful tool in your financial arsenal for achieving high-value property goals. Thorough preparation and understanding of your financial position are key to success with jumbo mortgages. Working with experienced professionals will guide you through the process and help you make informed decisions about your jumbo mortgage options.

Our advice is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.