Credit Card Time Bomb MyPerfectMortgage Reveals Risks

The following is an advertorial. We may receive compensation if you use a partner bank for financing. We never recommend a service we wouldn’t use ourselves. Period.

The Ticking Time Bomb

There’s a ticking time bomb no one is talking about.

It all started when inflation topped 6.5% in late 20221. Incomes couldn’t keep up.

So people started financing everyday items like groceries and clothing with credit cards. But that’s turning out to be a real problem.

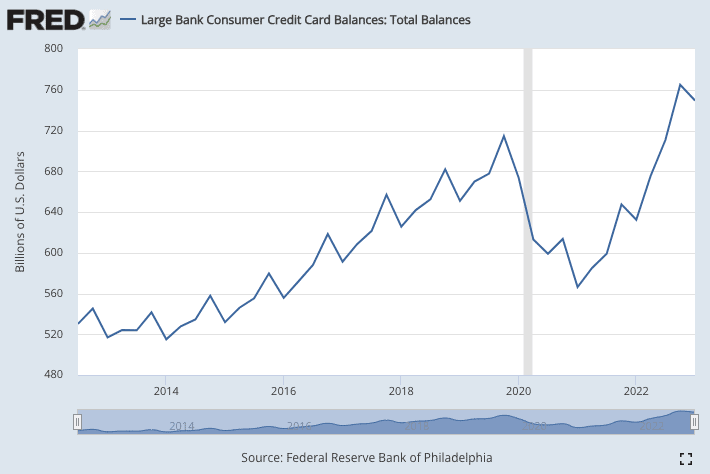

Worried about debt? See how much you can save with a cash-out refinance.U.S. consumer credit card debt shot from $566 billion in Q1 2021 to $750 billion in Q1 2023, says the Federal Reserve. The average consumer has nearly $8,000 in credit card debt2. Many consumers have $20,000 or even $30,000 in credit card debt.

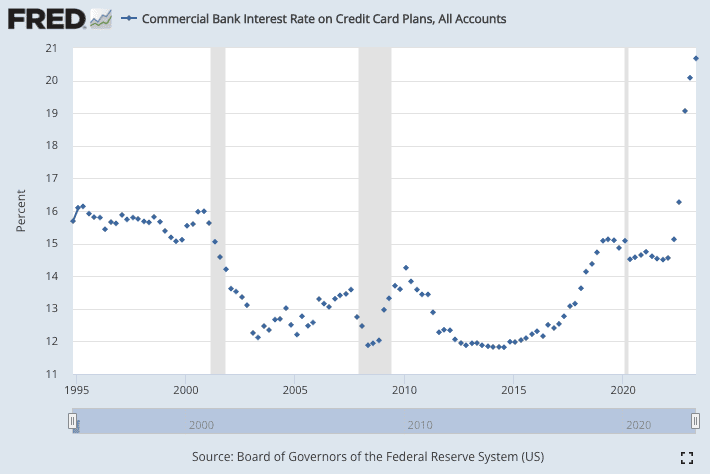

While this is nothing new in the history of consumers, something else is: the interest rate paid on that debt.

Credit card interest rates rose from 14.5% in early 2021 to 20.68% in 20233. That’s an all-time high since the Federal Reserve started tracking data in 1995. On a $20,000 loan balance, interest now tops $4,100 per year.

Going forward, consumers will have a harder time paying off balances as they pay record-breaking interest rates again and again each year.

Fortunately, There’s A Way Out For Homeowners

While renters may be in this predicament for some time, homeowners have a way to get out of the cycle: eliminate credit card debt with a cash-out refinance.

Home values have risen 29% since 2020 and the average homeowner now has $274,000 in home equity, putting them in a great position to consolidate debt. Credit cards, auto loans, and other consumer debt is fair game.

Yes, mortgage rates are higher today, but much lower than credit card rates. Depending on your debt level, you could come out ahead – both on interest savings and total monthly payment.

| Keep Current Mortgage | New Cash-Out Refinance | |

| Mortgage Rate | 3.5% | 7.5% |

| Mortgage Balance | $250,000 | $300,000 |

| Mortgage Payment (P&I) | $751 | $2,237 |

| Credit Card Payment | $700 | $0 |

| Car Payment | $1,200 | $0 |

| Total Payments | $2,651 | $2,237 |

See If A Cash-Out Refinance Can Help

A cash-out refinance shouldn’t be off the table just because mortgage rates aren’t as low as they used to be.

Looking at your total monthly cash flow and interest payments should be the deciding factor.

See how much you can save with a cash-out refinance.1 Fed Reserve Bank of Philadelphia

2 Annuity.org

3 Board of Governors of the Federal Reserve System

4 Corelogic