Get Expert Financing

- Matched with investor-friendly lenders

- Fast pre-approvals-no W2s required

- Financing options fro rentals, BRRRR, STRs

- Scale your portfolio with confidence

You served your country with pride and earned a comfortable retirement.

Whether you’re looking for more affordable housing, new job opportunities, tax breaks for your military pension, access to benefits and services from the Department of Veterans Affairs, or just a change of scenery—military retirees can face unique challenges other retirees don’t.

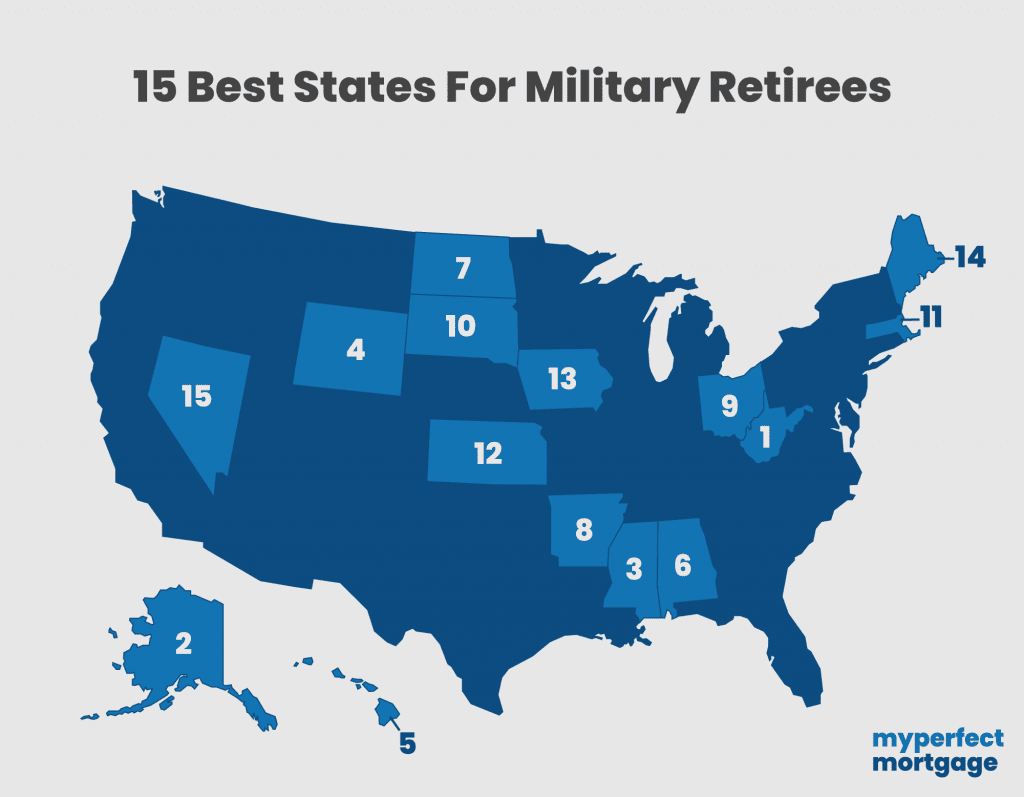

To help you out, we’ve looked at the major factors affecting military retirees, from military bases and VA healthcare facilities in the state to the cost of living and home prices.

We’ve compiled our list of the 15 best states for military retirees like you.

The most important issue for many military retirees and their families is whether their potential new home state will tax military retirement income.

That’s why, to make our list, a state must either have no income tax or offer a military retirement pay exemption from income tax as of January 2023.

Here is a full list of states that don’t tax military retirement pay.

Taxing military retirement income wasn’t the only criterion for whether or not a state made our list of 15 best places for military retirees.

We carefully considered many factors including:

Each factor above reflects the importance a state places on its military retirees and the level of support former military members can expect to receive if they live there.

No two military families are alike. And it’s important to remember that different factors will be more important to some individuals than others.

For instance, if you have health problems and plan to rent a home, choosing a state with many VA hospitals and clinics might be more important than a state with low home prices. That’s why we included sub-lists below showing the top states for each category.

Let’s take a closer look at each of our 15 states for military retirees.

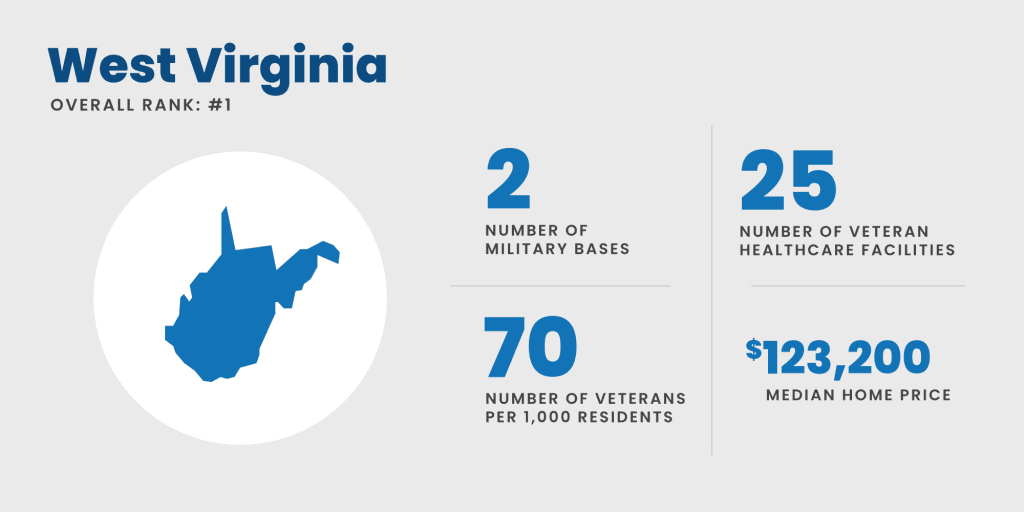

West Virginia ranks at the top of our list of best states for military retirees.

With a low cost of living, plenty of VA healthcare facilities, and a high allotment of VA resources per Veteran, ex-military, and their families will find the state an excellent place to retire.

If you’re interested in buying a home, check out the WV Housing Development Fund, which offers a zero-down loan plus closing cost assistance, and Veterans don’t have to be first-time buyers to qualify.

About 7% of the state population has served, so you’ll find friendly faces in clubs and associations wherever you go.

West Virginia offers several fun perks for Veterans, too, such as free hunting and fishing licenses for disabled and POW Veterans and a 10% discount at state park cabins and campsites.

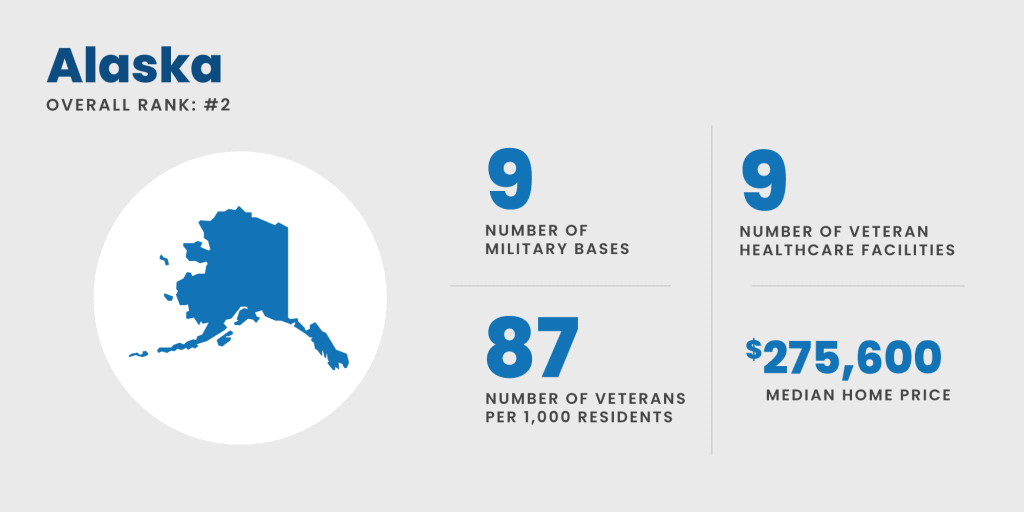

Alaska has more military retirees per capita than any other state.

That means you’ll find a large community of veterans to share your interests, whether that’s hunting, fishing, or taking in the peaceful natural environment. Alaska’s self-reliance mindset and independent spirit make it a great choice for many veterans.

Alaska’s Office of Veterans Affairs offers free assistance and support services, from filing education or medical claims to helping retirees receive earned service awards.

In addition to VA home loans, military retirees living in Alaska can access several programs to help them buy a home, such as a preferred interest rate, land discount, and land sale preference program.

Military retirees living with service-related disabilities can take advantage of additional benefits and discounts, including free camping passes and hunting and fishing licenses.

Other discounts include reduced fares when traveling on Alaska Marine Highway System (AMHS) vessels,

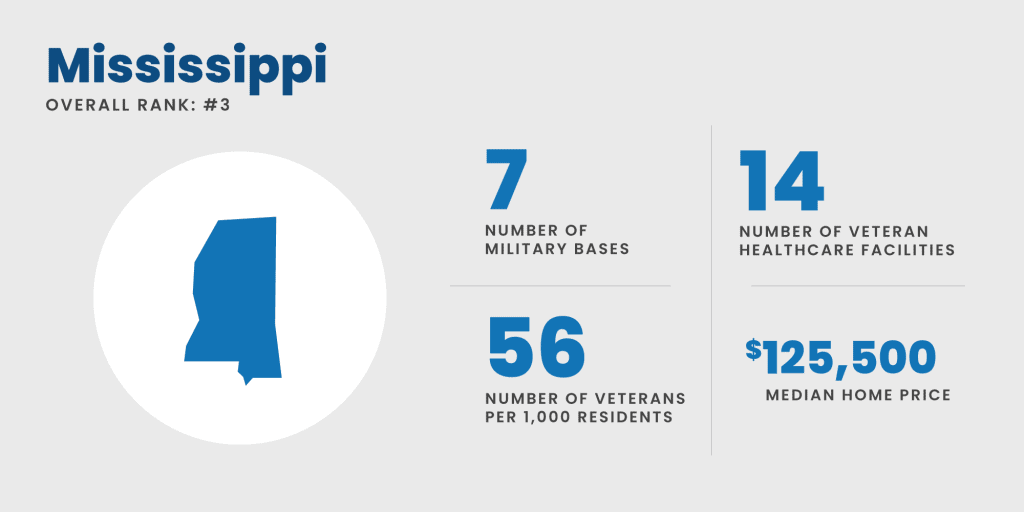

In addition to tax exemptions on military retirement income, Veterans and eligible spouses in Mississippi enjoy state education and tuition assistance, employment assistance and preferences, hunting and fishing license privileges, as well as special military vehicle plates and tags.

Mississippi is the most affordable place to live in the US, meaning retirement dollars will stretch farther than anywhere else in the country.

The Magnolia State offers something for everyone, and residents can enjoy a variety of recreational activities and events, such as the Mississippi Museum of Natural Science, the Grammy Museum, and the birthplace of Elvis Presley.

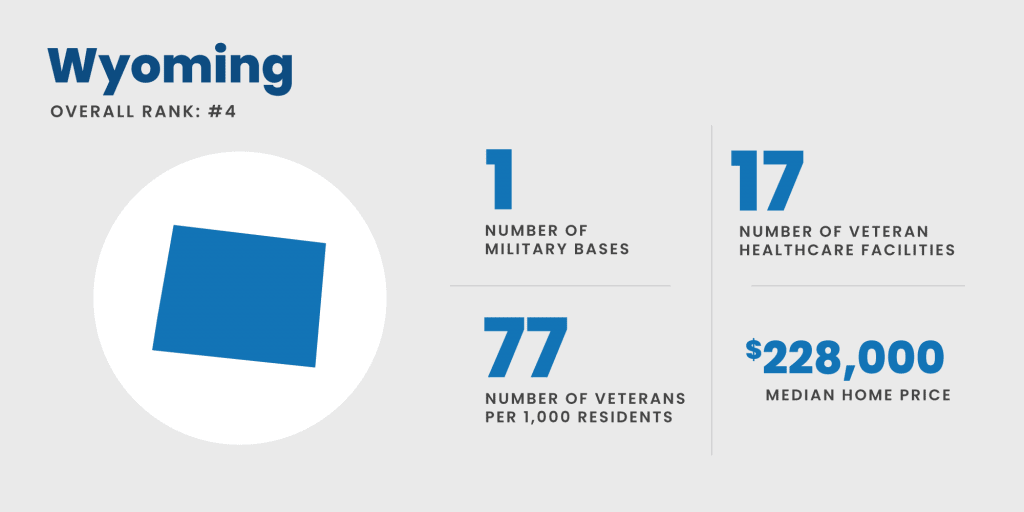

The home of Yellowstone National Park is also a popular retirement home state for many military Veterans.

In addition to tax exemptions, Wyoming offers its Veterans a number of treatment services and programs. Wyoming boasts more VA healthcare centers per capita than other states making a good choice if healthcare is a priority.

Military retirees are eligible for housing, employment, and education benefits, including reduced or free tuition at several community colleges, the Wyoming Law Enforcement Academy, and the University of Wyoming.

Veterans living in Wyoming are also eligible for reduced or free hunting and fishing licenses, and state park camping passes. And the Oregon Trail State Veterans Cemetery provides free burial for eligible Veterans, spouses, and their children.

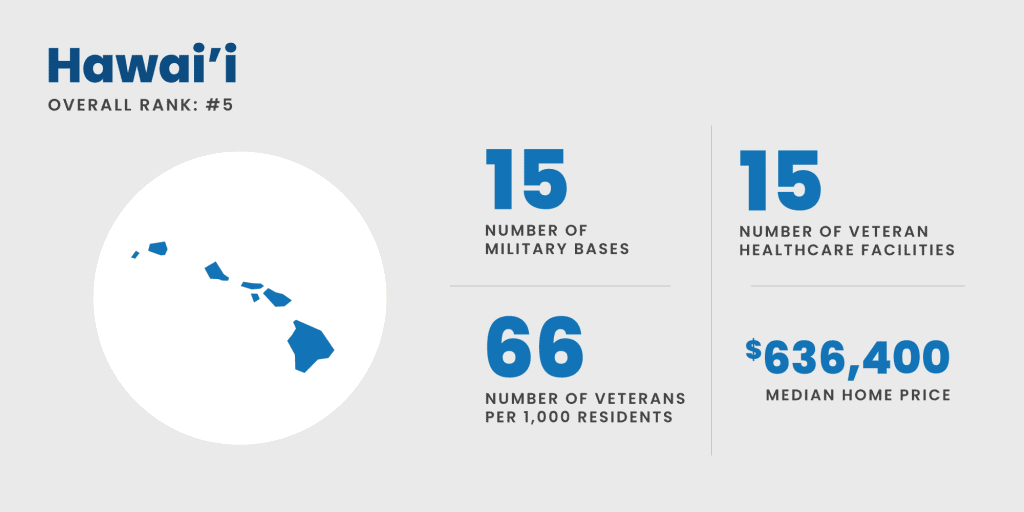

Offering a comfortable climate, miles of sandy beaches, and a stress-free island lifestyle, Hawai’i is a popular choice for many military retirees.

The Office of Veterans’ Services (OVS) is a great place for Veterans interested in accessing benefits, including education and training, employment, and medical and healthcare benefits.

Military retirees are retirement income and property tax exempt and enjoy employment preference at the county and state levels. Military veterans can also get reduced or free access to state parks and free hunting and fishing licenses.

Regardless of where you are in the archipelago, Hawai’i offers military retirees and their families great surfing and outdoor activities, world-class shopping and plenty of tourist activities, and low crime and safe living.

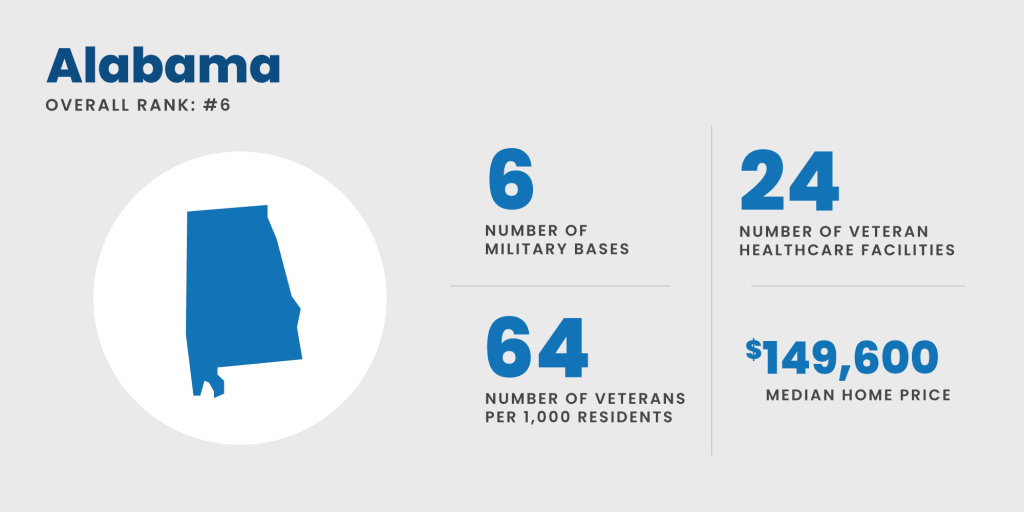

In addition to having one of the lowest costs of living in the country and low sales tax and income tax, Military retirees living in Alabama can enjoy tax exemptions on military retirement income and property tax exemptions.

Education benefits for Veterans can include a cash award of up to $5,080 per semester and other scholarship programs.

Alabama ranks among the top states with high percentages of veteran-owned businesses and is a popular choice for veterans looking to open their businesses.

Alabama also offers several state programs to support entrepreneurs, such as reduced-cost business and occupational licenses.

Those living in the Heart of Dixie can also enjoy exploring the state’s rich past, including historical sites in Birmingham, Montgomery, the Birmingham Civil Rights National Monument, and the Rosa Parks Museum.

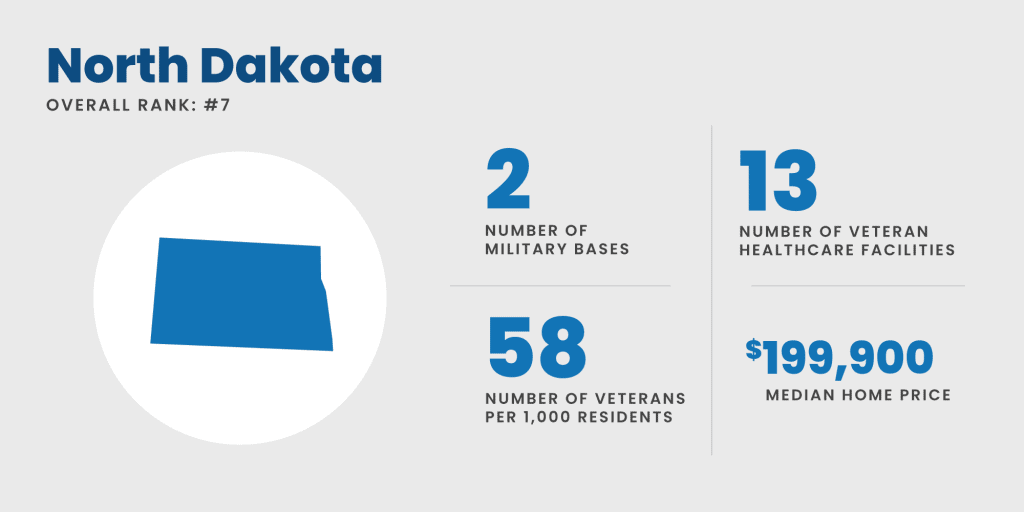

Veterans in North Dakota can take advantage of special benefits such as educational benefits, veterans’ preference for public employment, tax exemptions on retirement income, and property tax exemptions for military retirees with a disability.

With more than a dozen VA healthcare facilities, North Dakota is a popular state choice for Veterans prioritizing health and medical care.

Military retirees and their families can use a statewide online portal to check eligibility, schedule, change, or cancel medical appointments, as well as check on insurance or billing issues.

Additional benefits include:

State financial benefits also include cash loans up to $5,000 through the Veterans Aid Fund and the Post War Trust Fund (PWTF) Hardship Grant for eligible dental/denture work.

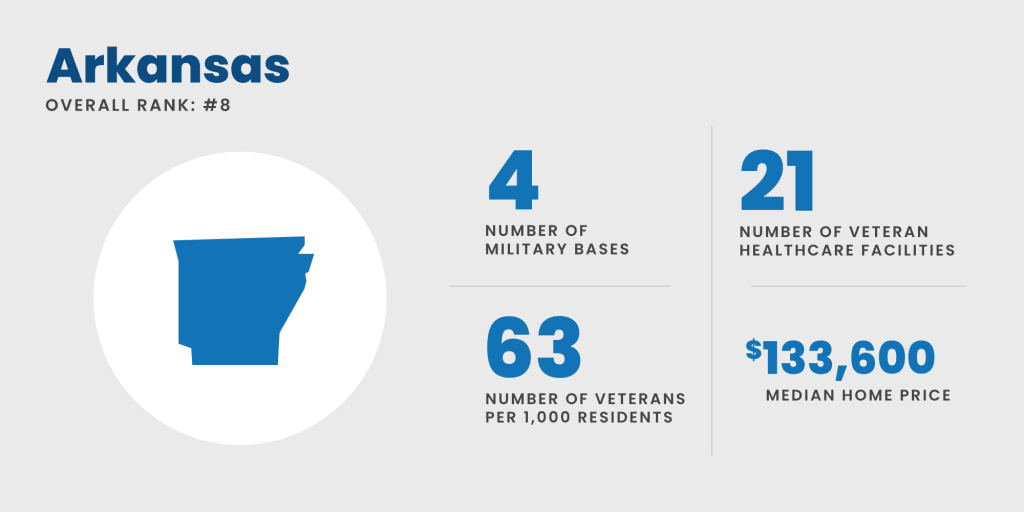

Arkansas offers affordable housing while continually ranking among one of the best places to live.

The Natural State boasts incredible outdoor attractions such as the Ozark Mountains, the Pinnacle Mountain State Park, and Petit Jean State Park.

For its military retirees, Arkansas offers property, retirement income tax exemptions, and several other benefits, including a protected Veteran Status under Arkansas’s Anti-Discrimination Laws.

Veterans can enjoy discounted passes at State parks and reduced or free hunting and game licenses, tuition discounts, waivers, and reduced or free special license plates and tags.

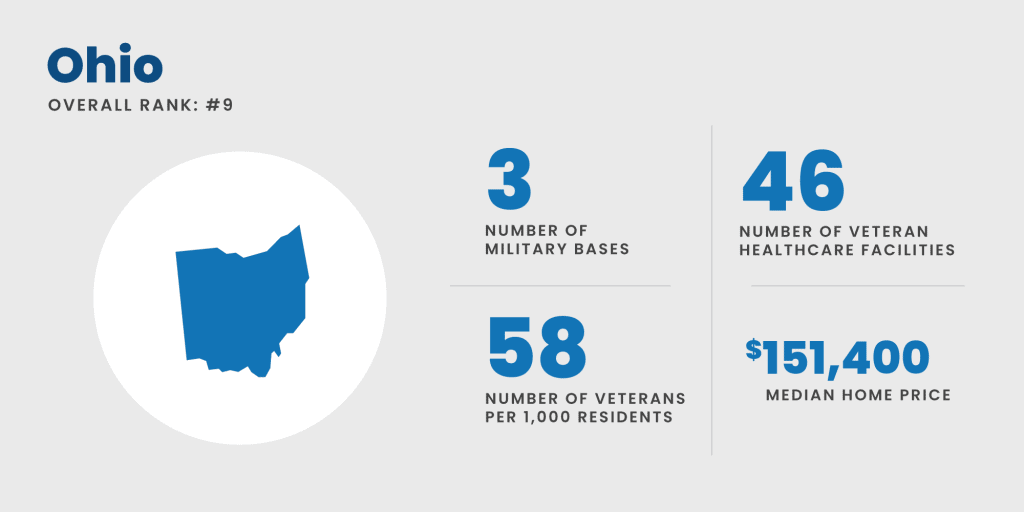

The Rock and Roll Hall of Fame in Cleveland is reason enough for many retirees to choose Ohio as their new home, but The Buckeye State is chock full of appeal, including four distinct, beautiful seasons to enjoy and gorgeous scenery in every direction.

There are special benefits for Ohio residents who are servicemembers, Veterans, or their families.

Some of these benefits include employment assistance, compensation for state active duty, special vehicle license plates, as well as fishing and hunting licenses, and state park privileges.

The Department of Veterans Services offers administrative support for residents who are veterans—all free of charge.

The department also operates the Ohio Veterans Homes in Georgetown and Sandusky, which are open to Ohio veteran residents who have served in periods of armed conflict.

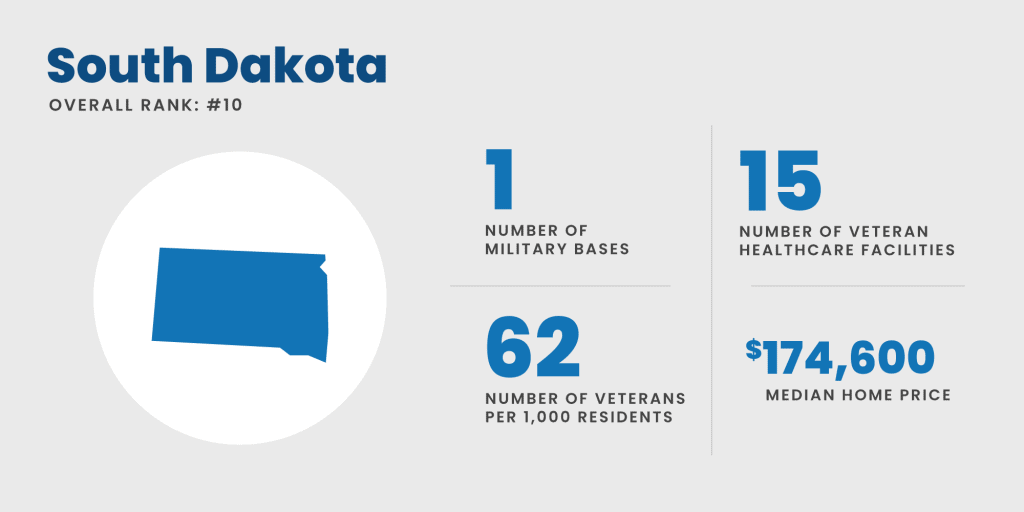

Living in South Dakota is affordable—generally 1.12 times less expensive than the rest of America.

That figure includes goods and services, which are 12.1% cheaper than most of the US. Overall, South Dakota has the 6th lowest cost of living of any state in the union.

For Veterans and their families, South Dakota offers special benefits, including a property tax exemption, education assistance, hunting and fishing benefits, and reduced fees (or free) at State Parks.

There are trained County and Tribal Veterans Service Officers with the South Dakota Department of Veterans Affairs who can assist in finding and applying for Veterans benefits under local, state, and federal laws. All of their services are available free of charge.

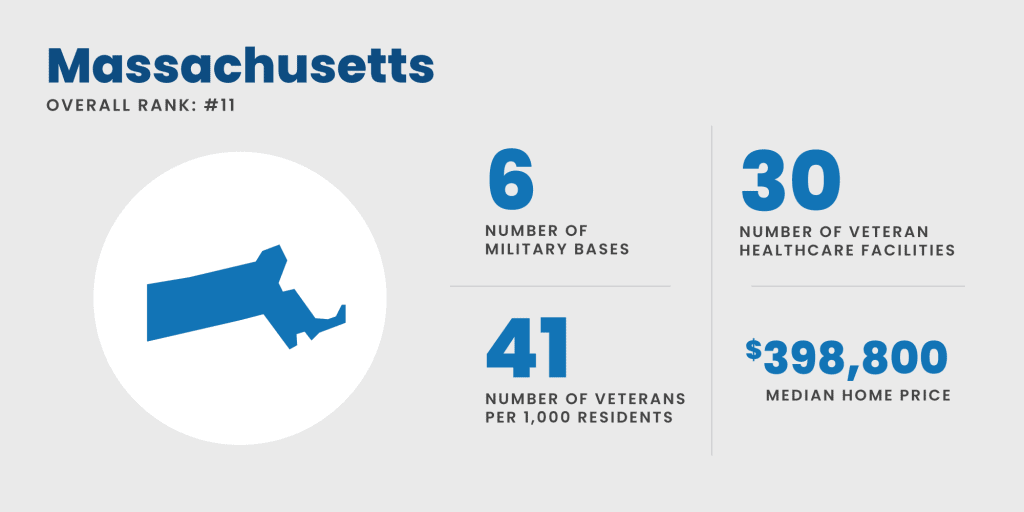

While most Americans know that Massachusetts holds an important place in US history, many are still surprised to learn just how much there is to celebrate and experience here.

Massachusetts has something for everyone, from some of the best sports teams in the country to world-class cuisine and medical care, all of which is surrounded by unmatched natural beauty.

Military retired pay isn’t taxed here, and there are several programs and special benefits available for military retirees who choose to call The Bay State home.

Eligible disabled veterans can get a special property tax exemption of $400-$1,500, and surviving spouses of a veteran whose death resulted from service can qualify for complete tax exemptions.

There is also a disabled veteran annuity of $2,000, payable biannually in two installments—available for 100% disabled veterans, their spouses, and Gold Star Parents.

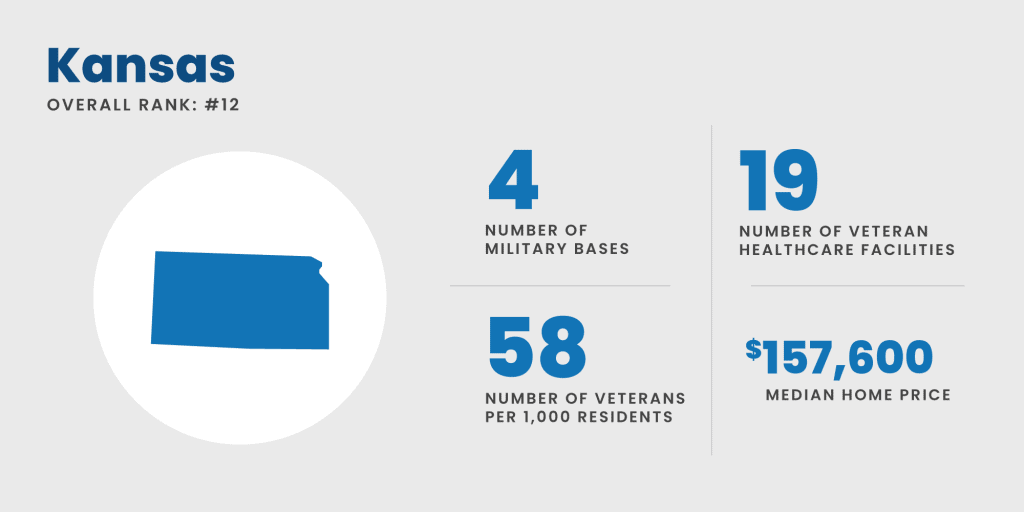

Kansas is often overlooked when considering retirement locations, but with a cost of living that’s 13.5% lower than the national average and an average of 225 sunny days a year, The Sunflower State offers a comfortable, affordable retirement option for military veterans and their families.

Veterans who include their military retirement income as part of their federally adjusted gross income are not taxed in Kansas.

Special military benefits, similar to other states, are also available here. The Kansas Commission on Veteran Affairs (KCVAO) and Veteran Service Reps (VSRs) also offer free assistance to veterans in Kansas.

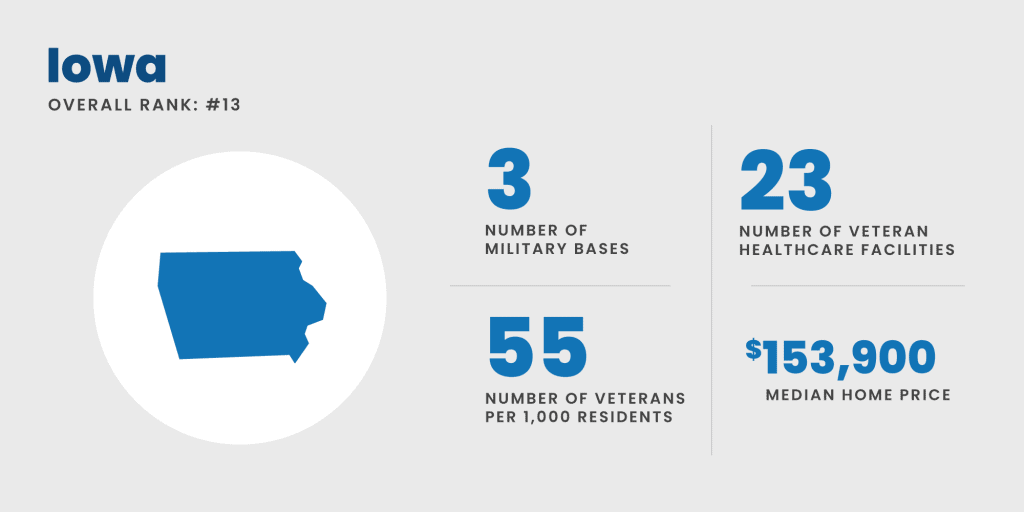

Iowa is another of America’s more affordable locations, with the cost of living at approximately 90% of the US average. Household costs are also just at 75% of the national average.

And military retirees don’t have to pay income tax on their retirement income with proper tax filing.

The Iowa Department of Veteran Affairs staffs benefits specialists accredited by the federal VA about their programs and state services.

These specialists are available to advise veterans and their family members on potential VA benefits, including disability compensation, pension, and other ancillary benefits.

The IDVA also has several other benefit programs that can help veterans, like the Injured Veterans Grant, Homeowner’s Assistance, and Property Tax Exemption, to name a few.

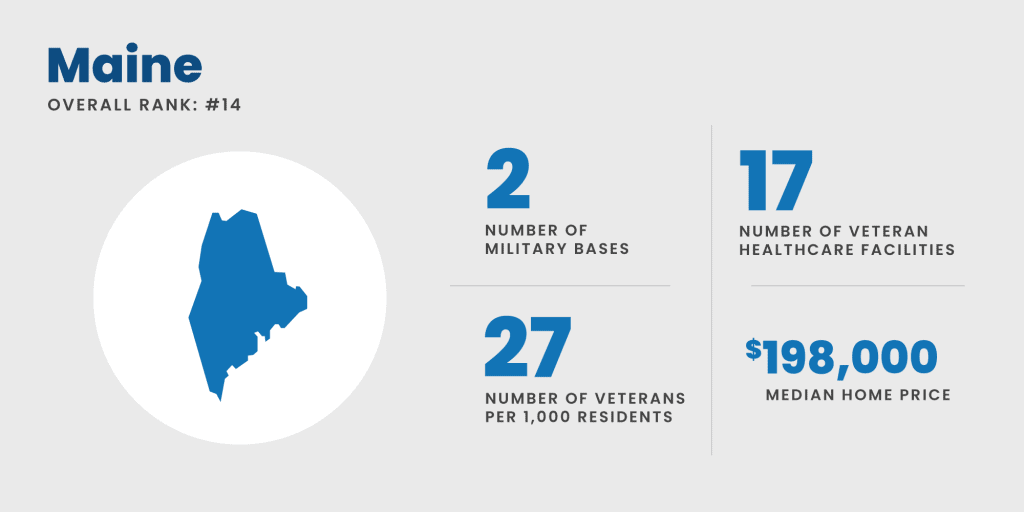

Planting roots in Maine means you’ll have access to some of the best healthcare around, including several of the highest-rated hospitals in the country.

Maine also has one of the nation’s lowest population densities, meaning there are plenty of quiet, open spaces around the state to explore and enjoy.

Maine’s low population, slower pace, and superior health care can be an ideal match for military retirees dealing with anxiety, PTSD, or other mood disorders. And Mainers are some of the nicest people you’ll ever meet.

The Bureau of Veteran Services offers assistance with several types of benefits, including identification, health and dental, housing, tax exemption, recreational licenses, and services.

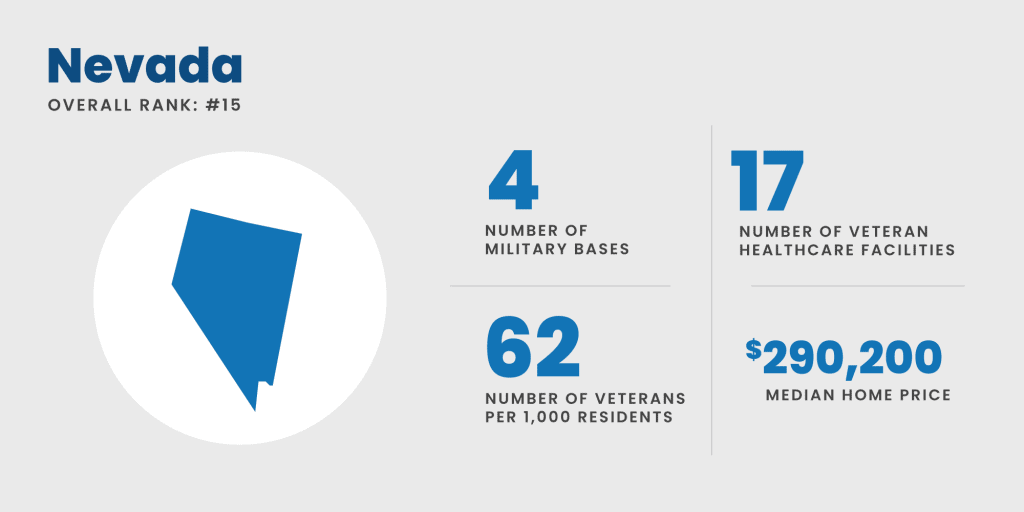

If you prefer a dry climate, Nevada could be your place.

Nevada, a mountainous region rich in semiarid grasslands and sandy deserts, is considered the aridest state in the US.

Nevada does experience all four seasons. And while the summers are typically hot and dry, the winters are generally short, although occasionally snowy and windy.

Not only is Military retirement income non-taxable, no one in Nevada pays individual income tax.

In addition to tax-free living, The Sagebrush State’s Department of Veteran Services features several benefits and services including outreach programs, legal assistance, housing assistance, etc.

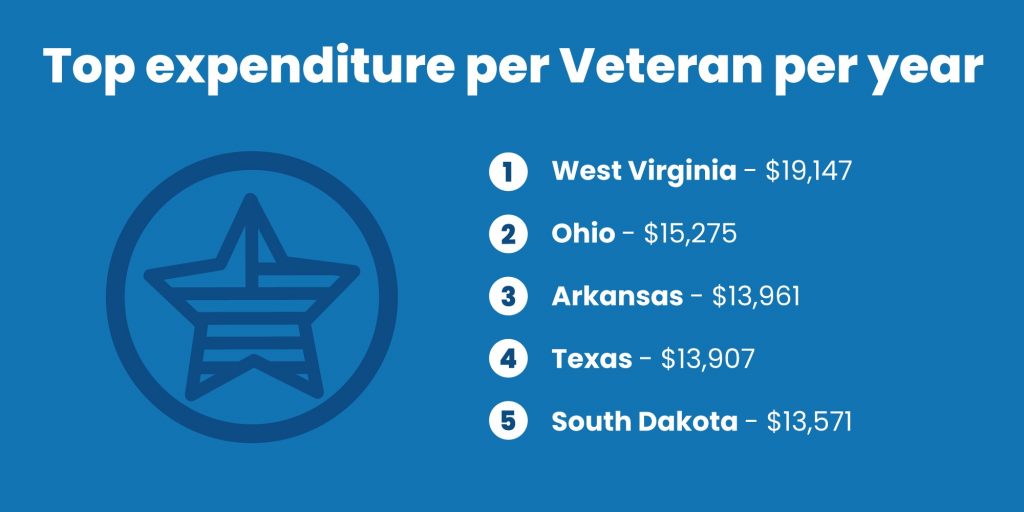

Different aspects of life and retirement are most important to each military retiree. That’s why we gathered a list of top 5 states in a few different areas to help you decide where to retire.

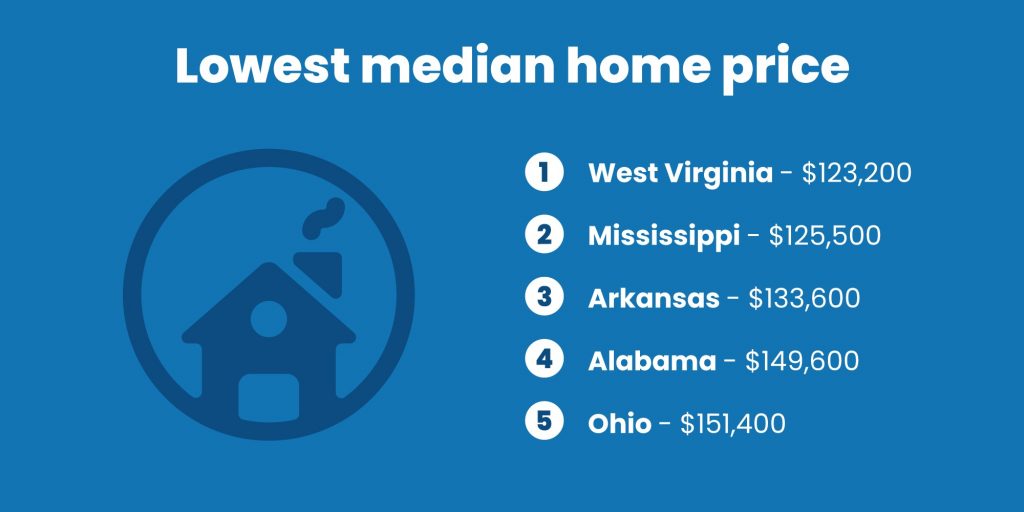

While not having to work anymore is one of the best benefits of being retired, it won’t do you much good if most of your retirement income is going towards housing.

Finding the right state with the right housing price range can be a crucial aspect of making the right choice. To help you out, we’ve compiled a list of the top five states where home prices are the lowest.

Keep in mind, too, that veterans could also be eligible for a zero-down VA home loan to help afford their best home.

Retirement is one of the most exciting yet challenging times in a person’s life. For many, it’s a time to travel, take up hobbies, and enjoy a more relaxed lifestyle.

But it’s also a time to make big decisions about your future, and that can be daunting. That’s why it’s important to plan ahead for retirement. Here are 5 things to consider when you’re ready to retire.

As a military retiree, you likely have adequate service for VA home loan eligibility. With a VA loan, you can get below-market mortgage rates, zero down, and no monthly mortgage insurance.

This makes buying a home in your chosen state that much easier. And, the payment on a VA loan will use less of your retirement income compared to many other loan options.

Get ready for retirement by buying a home with a VA loan.

Start your VA home loan here.Financial planning is one of the most important aspects of retirement. Understanding your income and expenses and creating a budget that works for you and your family is crucial.

You should also consider how you will invest your money to ensure it lasts throughout your retirement.

Take some time to learn about the different types of retirement accounts and how they can help you save and invest. Don’t forget to look into different tax strategies that can help you save money and make the most of your tax-exempt military retirement income.

Another important consideration for many military retirees is healthcare.

Healthcare needs may change as you age, and it’s always a good idea to be prepared. Look into health insurance options, including long-term care insurance, to see what works best for you.

Contacting the Department of Veterans Affairs can be a great starting point to help you make the most of your post-military years.

A carefree retirement means understanding your Social Security benefits and the different ways you can maximize them, including their tax implications and how they can affect your retirement income.

Having a solid understanding of Social Security can help you make the most of your retirement income benefits and ensure you have enough money to comfortably last throughout your retirement.

Retirement also involves major lifestyle changes. Give careful consideration to how you’ll spend your time and stay active.

Do you want to work? Start your own business? Spend time on a favorite hobby? Explore state groups and organizations and see which hobbies and activities appeal to you.

Legal planning is also important when preparing for retirement. From wills to trusts and powers of attorney to estate planning, having your legal planning in order can take a lot off your shoulders.

A solid legal plan in place can help ensure that your wishes are respected—and your assets protected.

After serving your country, you deserve a retirement spot in a state that recognizes the value of your contributions and supports you in your golden years.

No two retirees are alike, and each Veteran’s retirement requirements will vary. That’s why it’s important to consider your options carefully, thoroughly investigate all the benefits each state offers, and see which matches your list of needs and wants the best.

Learn more about the VA home loan program and how it can help you in retirement.We looked at more than 9,200 pieces of data to determine which states are best for military retirees. Here are all the elements we considered and the percentage of the overall rating given to each one.

Select sources:

Our advice is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.