Your credit score plays a critical role in qualifying for a mortgage and securing the best loan terms. If your score isn’t where you want it to be, don’t worry—there are proven strategies and tools to help you build and improve your credit.

A strong credit score can mean the difference between approval and rejection—or thousands of dollars saved in interest over the life of your loan. Here’s how improving your credit helps:

A higher credit score often translates to lower interest rates, saving you money.

Expand the number of lenders willing to work with you.

Demonstrating strong credit makes the approval process smoother and quicker.

A strong credit score can help you qualify for lower down payment options, making homeownership more accessible.

We’ve partnered with trusted credit-building and repair services to help you achieve your mortgage goals:

Repair your credit with personalized strategies tailored to your financial situation. Ava Finance makes it easy to take control of your credit and start seeing results.

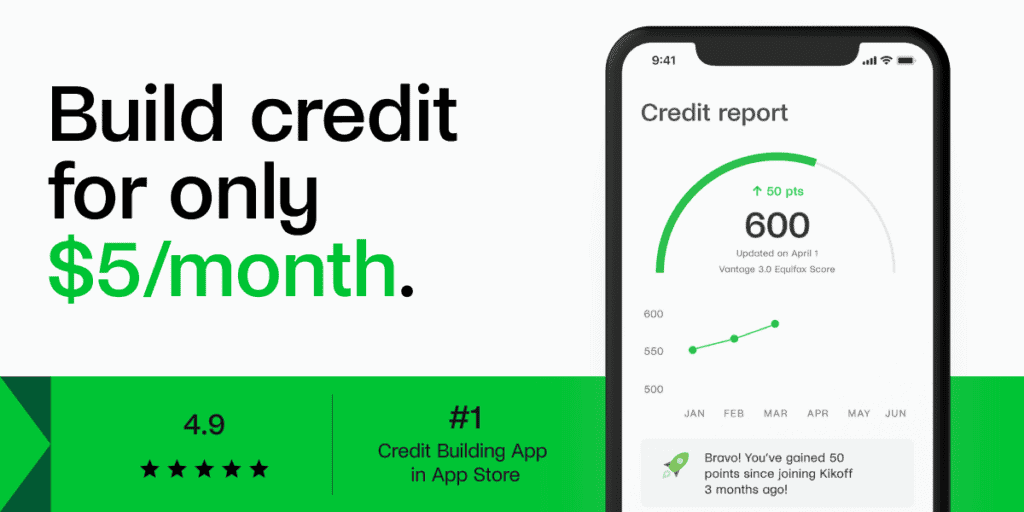

Boost your credit score quickly with Kikoff’s $5/month credit line. It’s a simple way to start building your credit without taking on unnecessary debt.

Build your credit while learning valuable professional skills. Kovo helps you improve your credit with easy, affordable monthly payments that build positive credit history.

Give Yourself The Credit You Deserve

Vola Finance offers cash advances and tools to build better money habits. Track spending, avoid overdrafts, and improve your credit profile for greater financial stability.

Get instant cash advances with Vola Card—build your credit while you spend!

Improving your credit is one of the smartest steps you can take toward qualifying for a mortgage and securing better terms. Get started today with these trusted resources:

• Start Building Credit with Kikoff

• Repair Your Credit with Ava Finance

• Boost Credit and Skills with Kovo

• Strengthen Your Credit with Vola Finance

Your journey to homeownership starts with strong credit. Let’s make it happen!