Unlock Your Home Equity with Figure

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

One of the major advantages to a home equity line of credit, or HELOC, is that it doesn’t cost you as much as a full-blown refinance.

If you shop around, you may find a lender with zero upfront HELOC closing costs.

Now, when I say zero, I mean the fees may be baked into the interest rate, or the lender might charge you if you close the HELOC too soon.

But if you want a cheap way to access your home’s equity, a HELOC is probably the ticket.

It doesn’t matter what HELOC closing costs are if the lender doesn’t charge you, right?

That’s why your first step should be to find a great HELOC lender. Here’s where to look.

My Perfect Mortgage lender network: We can match you with the right HELOC lender here.

Your local credit union: We compiled a list of credit unions in every state. Many may offer zero-cost HELOCs.

National banks: Some national banks offer no application fees, no closing costs, and no annual fees. Some don’t even charge a fee to lock in a rate after closing.

Local banks: Regional banks offer HELOCs for outside-the-box scenarios such as lower credit, investment property HELOCs, and more.

There’s no guarantee you can find a no-closing-cost HELOC lender (even though there are great credit unions that offer up to 100% LTV HELOCs in almost every state).

So what fees might you pay? Here are potential upfront and ongoing fees. Keep in mind that you probably won’t pay all these fees, just one or two, most likely.

| Upfront fee | Approx. Amount | Purpose |

| Appraisal | $300-500 | Assess the current value of the home |

| Escrow/signing | $150 | Fee for a notary to assist in final paperwork signing |

| County recording | $100 | Records the new loan with the county |

| Credit report | $50 | Verifies your credit score and history |

| Title | $350 | Search for other liens and verify ownership status of the property |

| Taxes | 1% | Some states tax refinances and home equity lines and loans |

| Post-opening fee | Approx. Amount | Purpose |

| Interest | varies | Perhaps the most important fee of all. The amount you’ll pay to borrow each year. |

| Annual fee | $50-100 | A fee charged each year whether you use the HELOC or not, somewhat like a credit card annual fee |

| Fixed-rate lock-in | $25-100 | To lock in a portion of the outstanding variable rate HELOC into a fixed-rate loan. |

| Transaction fee | varies | A charge for each draw from the HELOC |

| Early termination | varies | The lender doesn’t make money on interest if you close the line of credit too early, so they charge a fee to do so. |

| Recording | varies | Removes the loan from the property on county records upon termination of the loan. |

Your biggest expense is likely to be your appraisal. The good news is that not all HELOC lenders require them.

Shop around for a lender that only requires an automated valuation model, or AVM. An AVM is a computerized system that estimates your property value and is often free to you.

But AVMs are a little like Zillow estimates: take them with a grain of salt.

If the AVM doesn’t give you the value you need, many lenders will order an official appraisal, which gives a more accurate – and hopefully higher – value.

If you opt for an appraisal, the fee is upwards of $500. Not cheap, but worth it if it helps you get approved for the HELOC.

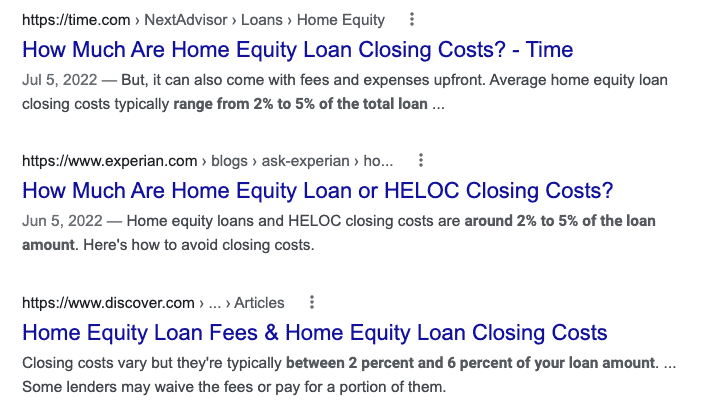

Let me stop the myth here that HELOCs and home equity loans cost 2-5% in closing costs.

Public Service Announcement: Home equity lines and loans do not cost 2-5% of the loan amount in closing costs.

The 2-5% figure is a very rough estimate of what it costs for a full refinance – like to replace your primary first mortgage. But many writers without real-world lending experience have assumed this number is the same for home equity loans and HELOCs. Bad journalism!

It’s simply too high. You won’t pay this much for HELOC closing costs unless you got a very bad deal. If you pay 3% in closing costs, that’s $6,000 for a $200,000 HELOC or home equity loan. That’s outrageous, as you’ll see below.

TIP: If you’re worried about higher closing costs with a home equity loan versus HELOC, you can likely lock in your HELOC balance after closing. This essentially gives you a fixed, closed-end home equity loan at lower fees.

Home equity loans (fixed 2nd mortgages) may have higher closing costs versus variable-rate, open-ended HELOCs. But it won’t be 2-5% or anywhere close to the closing costs of a full refinance.

Here are some example fixed home equity loan closing cost figures found online at the time of this writing.

This small sample supports the theory that home equity loan costs are the same or slightly higher than for HELOCs – but much lower than for a full refinance.

A fixed-rate home equity loan might come with slightly higher closing costs than a HELOC, but not astronomically so. The home equity loan lenders we reviewed offer closing costs well under $1,000 and some had no fee at all.

No. This is how much a full refinance would cost, but the benefit of getting a HELOC or home equity loan is that it comes with much lower costs, often zero upfront costs, in fact.

Local credit unions and banks are often best, offering zero-closing-cost home equity products. Some national banks offer low- and no-cost HELOCs as well. We can also connect you with a low-cost HELOC lender here.

The bottom line is that home equity products are a great value compared to the thousands of dollars it costs to get a full-blown refinance.

You can tap into your home equity at a low cost and without touching your low-rate first mortgage.

Our advice is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.