Get Expert Financing

- Matched with investor-friendly lenders

- Fast pre-approvals-no W2s required

- Financing options fro rentals, BRRRR, STRs

- Scale your portfolio with confidence

You’re exploring the world of reverse mortgages and wondering if it’s the right financial move for your unique situation. Look no further!

We’ve handpicked five reverse mortgage examples to help you navigate through the complexities of this popular financial tool.

These real-life scenarios should shed light on reverse mortgages’ benefits and potential pitfalls.

Check if you can qualify for a reverse mortgage.Calculating your reverse mortgage amount is the first step to determining whether this financial product suits your needs.

The reverse mortgage amount is calculated based on several factors, including:

Unfortunately, your reverse mortgage maximum loan is not easy to estimate like a typical “forward” mortgage.

When you refinance into a forward loan, you can usually get up to 80% of the home’s current value. With a reverse mortgage, it’s more lie 40-60% or even less, depending on the above factors.

And a reverse mortgage can never be above the national FHA lending limit of $1,089,300 for 2023.

Let’s look at five reverse mortgage examples to give you a better idea on borrowing limits.

If you’re wondering how a reverse mortgage might look in real life, here are five specific reverse mortgage examples.

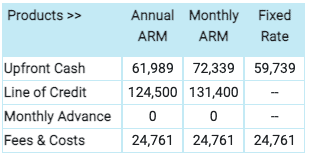

Using the above criteria, this borrower could receive a $72,339 cash upfront and a line of credit of $131,400.

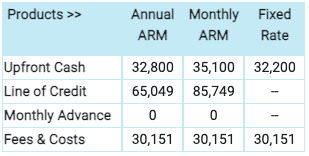

To give you a better insight into how different mortgage types and rates will affect the end result, we’ve included a monthly adjustable-rate mortgage, an annual ARM, and a fixed-rate mortgage.

As you can see, the type of reverse mortgage you choose affects the cash and the line of credit amounts you could receive.

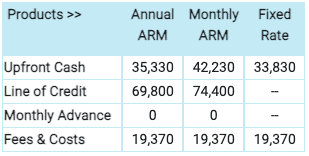

Does this scenario match your situation? Start your reverse mortgage here.Note the younger age of the borrower in this example and how they could receive only $42,230 upfront and a line of credit of $74,400.

This example illustrates how a younger age reduces the amount you could receive. Perhaps there are other strategies to give you more financial runway in retirement.

Older borrowers can access a more significant portion of their home’s equity based on shorter life expectancy. Why? Because the longer your life expectancy, the more a reverse mortgage balance can grow.

Remember that regardless of how the money is distributed to you, a lender will add interest each month to the balance. That means the principal you owe will go up over time, decreasing the equity in your home accordingly.

Therefore, you must have enough equity in the home to cover expenses like taxes, insurance, and HOA (if applicable) for the following two to three decades.

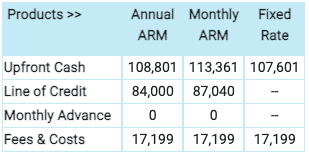

This borrower could receive $113,361 upfront and a line of credit of $87,040.

In this example, the borrower’s age means they’re eligible for about the same amount as the younger homeowner in Example 1—despite that person having more home equity.

There is actually no upper age limit for a reverse mortgage—plus, an older age has a greater advantage with these loans.

Older homeowners won’t have to maintain as much equity in their homes because they usually don’t need to pay housing costs (taxes, etc.) for as long.

Are you eligible for a reverse mortgage? Start here.In this example, the younger borrower with the higher-value home could receive $35,100 upfront and a line of credit of $85,749.

62 is the minimum age to be eligible for a reverse mortgage, but it doesn’t mean you should dive into a reverse mortgage right away.

This borrower has $800,000 in equity and might consider a reverse mortgage for a worry-free retirement.

However, their relatively young age means they still need to have enough equity left to pay for expenses (i.e., taxes) for several decades.

They will also likely accrue interest for much longer, risking their debt load overtaking their remaining equity.

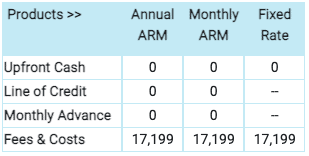

Finally, this is a good example of a homeowner who is likely not eligible for a reverse mortgage unless they can bring a lot of cash to the closing table.

First, the typical minimum equity requirement for a reverse mortgage is 50%, though even more is ideal. Second, even if they were somehow to get a reverse mortgage approved, they would not receive funds at closing, and couldn’t even pay off the underlying loan.

If you have a current mortgage balance of more than 50% of your home’s current value, you might consider getting a home equity line of credit instead.

Note: All calculations were created using the calculator on ReverseMortgage.org. None of the above examples should be taken as quotes; the costs listed are only estimates. Interest rates, as well as other factors, will affect your actual results.

These reverse mortgage examples show how different outcomes might happen depending on several factors.

One of the best ways to find out if a reverse mortgage is the right fit for you is to start the process. There’s no cost in applying, and it will likely answer your remaining questions.

Start here to get qualified for a reverse mortgage.Our advice is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.