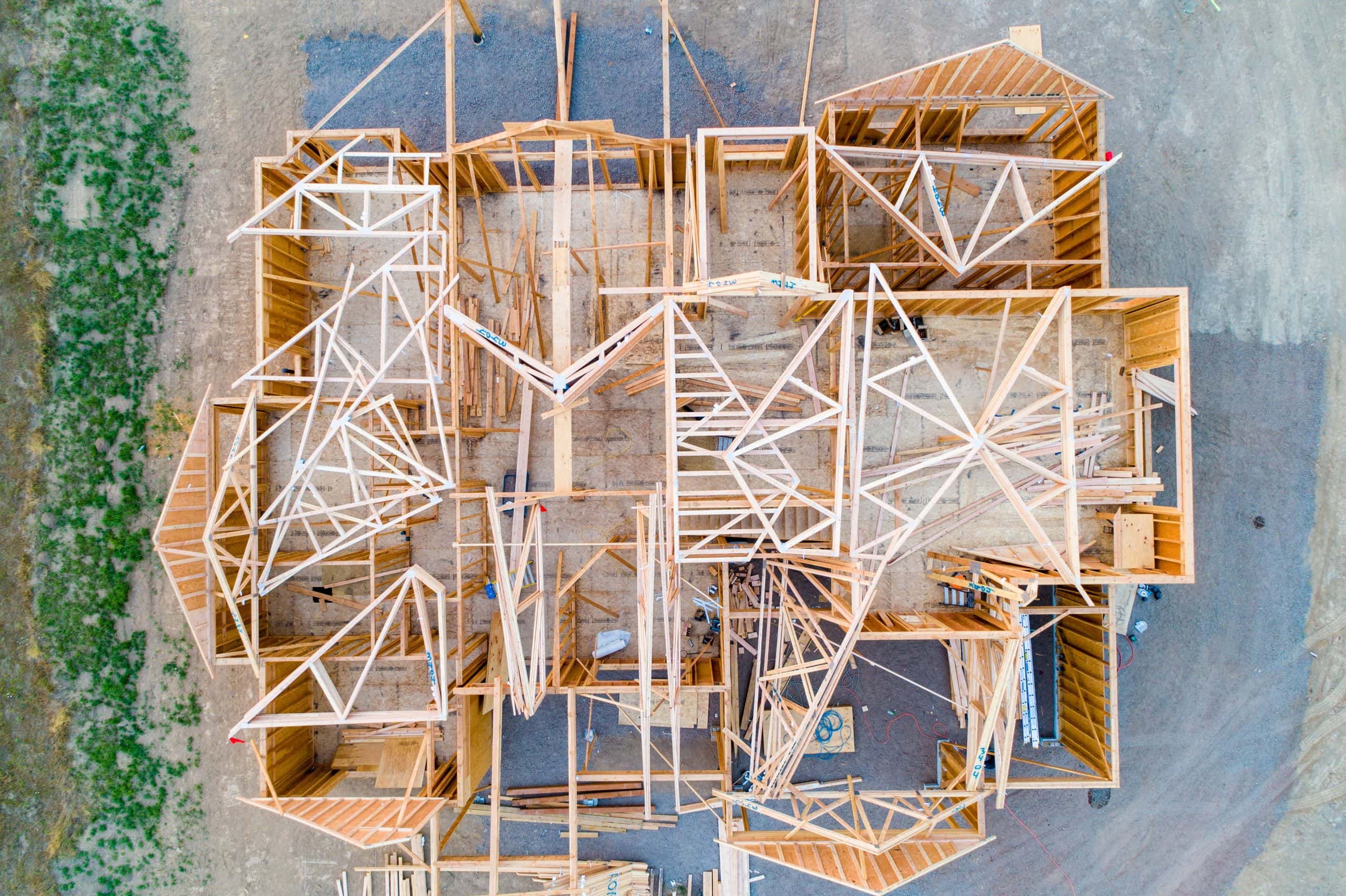

Whether you want to build a custom home or need a specially designed building to do business, construction loans simplify how you buy and build property.

Made to apply to a wide range of scenarios, construction loans allow borrowers to secure financing based on the finished property value and project costs, rather than solely relying on your personal finances.

For homebuyers, builders, contractors, and real estate investors that want to build a new home, business, or investment property, construction loans offer lenient qualification requirements and flexible terms to secure financing that meets the needs of each unique situation.

Connect with the perfect lender to explore your options and see what you qualify for.

Get approved with less documentation through simple underwriting

Move quickly to purchase available property with flexible loan qualifications

Afford a new build or the renovations needed to complete your project

With a construction loan you can qualify for a short-term mortgage that will finance the costs of building or renovation, including land purchase, building plans, permits, labor, and materials.

This allows homebuyers, builders, contractors, and investors to complete projects within necessary timelines and then pay back financing or refinance the loan on the property.

With flexible qualification requirements that apply to multiple property types, you can secure a construction loan based on your finished property value and project costs, rather than your income, employment, and other personal finance considerations.

Is a construction loan right for you?

Construction loans can be used for new construction or to renovate an existing building. They’re available to a range of people, from real estate investors to homebuyers.

With a strong and clear building plan, construction loans work well for many scenarios.

You may qualify for an owner-occupied loan as a business or consumer. For example, as a consumer you may want to build your new dream home, or as a business, you may want to build a new office building for your team.

Maybe you want a non-owner occupied loan and need to qualify as an investor who plans to build a property and sell it.

Construction loans provide financing for a specific investment purpose. They cover the costs of planning and building real estate, rather than the funds to purchase or refinance an existing building. For this reason they’re offered with shorter term lengths, meant to cover the timeline of the building project.

These investments are riskier for the lender, as there isn’t yet an existing building, so the interest rates are slightly higher for construction loans.

They meet unique financing needs of construction projects by offering flexible qualification requirements based on the value of the finished property. This makes them more accessible than standard loans that require certain income and other documentation related more to the borrower’s personal finances than the project itself.

Although your personal income may not be considered for financing if the project is for business purposes, you will need to authorize a credit report. The minimum requirements vary depending on the situation and can be more flexible than standard banks allow.

In many cases a credit score of 680 or higher is often best.

When you close on a construction loan, a portion of the loan amount is immediately used to purchase the property or land.

The remaining balance is typically kept in an escrow account, which is then disbursed to you, the borrower, as the project proceeds, based on agreed-upon phases of the project between you and the lender.

There are closing costs associated with processing any loan, and the costs of a construction loan are comparable to standard mortgages. They include costs for the lender to service the loan, as well as an appraisal and other fees.

You’ll also need to make a down payment that will be paid at closing. The down payment amount will depend on the specific details of your project.